Free Template

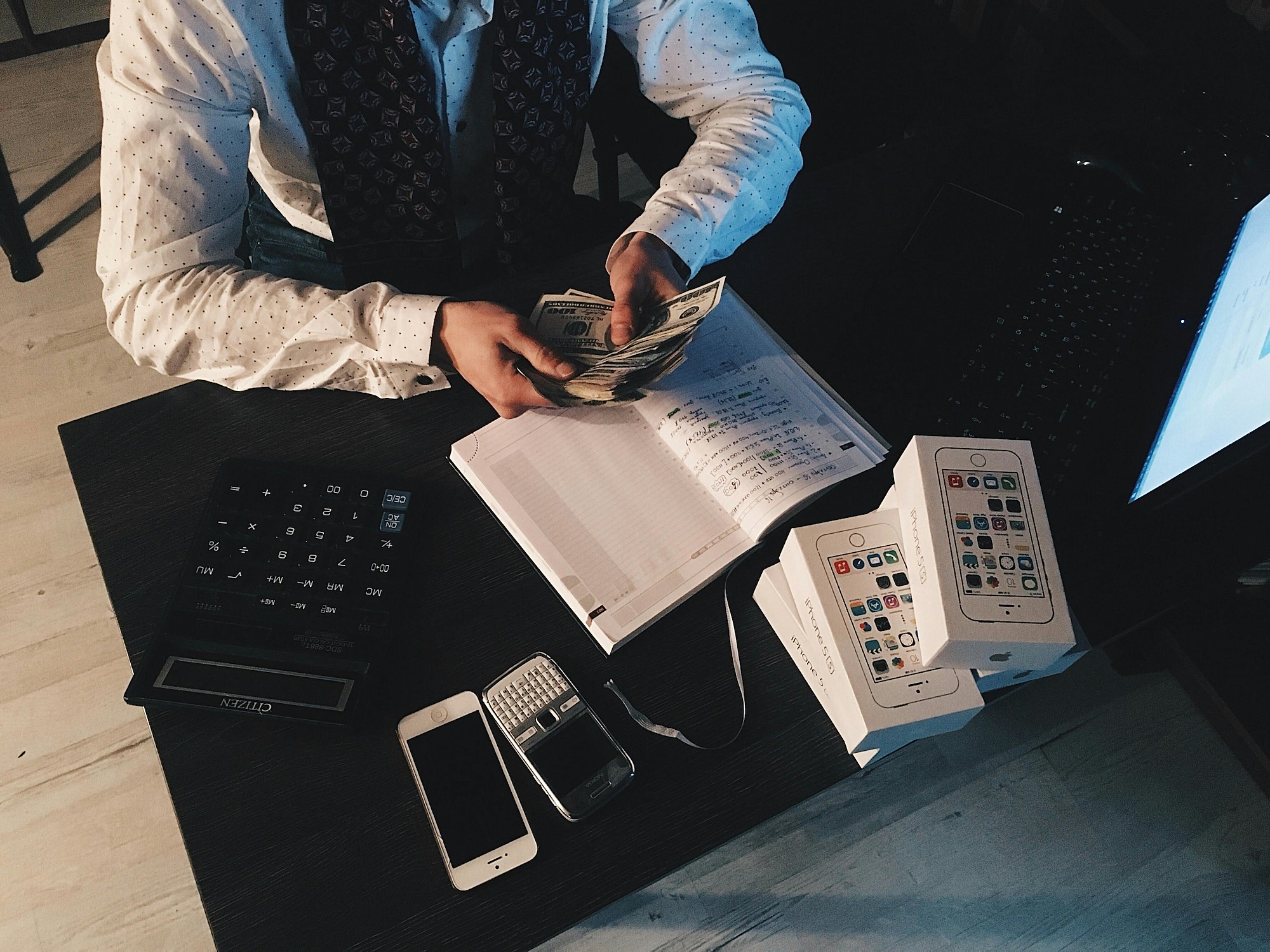

Balance the Books with Confidence: Create bookkeeping contracts to outline services, secure payments, and ensure smooth financial management for your clients.

***

A Bookkeeping Contract is a legal agreement between a bookkeeper and client that clearly defines the bookkeeping services provided, such as reconciliations, payroll, or financial reporting, along with payment terms, deadlines, client responsibilities, confidentiality, and termination conditions.

***

Hey there, number crunchers! Are you a bookkeeper or a business owner looking to get your financial ducks in a row? Well, you're in luck! A bookkeeping contract is here to save the day.

So, what's a bookkeeping contract? Simply put, it’s an agreement between a bookkeeper and their client that keeps both parties safe from misunderstandings and disputes.

What's in the contract?

Why do I need one?

Great question! A bookkeeping contract:

Basically, it's a must-have for any business that wants to keep its finances in order!

Short answer? All bookkeepers! No matter where you’re keeping track—whether you’re flying solo as a freelancer, working in-house for a small business, or tackling projects for a big company—having a contract is a must. Here’s why:

Contracts are like a safety net for your business. They make sure everyone's on the same page about what needs to be done when it's due, and how much it'll cost. It’s like a map that keeps everyone from getting lost!

When it comes to a solid bookkeeping contract, there are a few must-have ingredients to keep things smooth and drama-free. Here’s what you need:

Including these essentials will keep everyone in sync and help avoid any “uh-oh” moments down the road. It’s all about making the work as seamless and hassle-free as possible!

So, you’re thinking about diving into the world of bookkeeping? Great choice! But what’s the pay like? Well, it depends on your experience, location, and what kind of magic you can work with those numbers. Here’s the lowdown:

As for yearly salaries, full-time bookkeepers usually make between $40,000 and $60,000. But if you’re a freelancer with multiple clients or niche expertise, you might rake in even more!

Getting hired as a bookkeeper takes more than just being good with numbers. Here’s how to make yourself stand out:

There you have it! With the right skills, networking, and a bit of hustle, you’ll be on your way to bookkeeping success in no time.

With Butterscotch, handling your bookkeeping contracts is a breeze! Here’s how it works:

In a nutshell, having a solid bookkeeping contract is a must for any bookkeeper who wants to keep things professional and avoid conflicts. And Butterscotch makes it ridiculously easy to create, manage, and get those contracts signed, all while letting you collect payments and signatures online. Ready to make your bookkeeping life easier? Give Butterscotch a try and see for yourself!

This Bookkeeping Services Contract ("Agreement") is made and entered into on [Start Date], by and between:

1. Independent Contractor Relationship and Liability for Taxes:

The Bookkeeper is an independent contractor and not an employee of the Client. The Bookkeeper shall be responsible for all taxes, insurance, and other statutory obligations arising from their income. The Bookkeeper will not be entitled to any benefits or protections provided by the Client to its employees, including but not limited to health insurance, unemployment insurance, and worker's compensation insurance.

2. Scope of Work:

The Bookkeeper agrees to provide the following bookkeeping services:

3. Contract Term and Schedule:

4. Licensing Information:

The Bookkeeper represents that they are fully licensed, certified, and qualified to perform the bookkeeping services outlined in this Agreement in accordance with the laws of [Specify State/Country].

5. Fees and Payment Terms:

6. Materials and Expenses:

7. Confidentiality and Data Security:

8. Client Responsibilities:

9. Amendments:

This Agreement may be amended only by a written document signed by both parties. Any changes to this Agreement must be discussed and agreed upon before they take effect.

10. Termination:

11. Dispute Resolution and Remedies:

12. Signatures:

By signing below, the parties agree to the terms and conditions outlined in this Bookkeeping Services Contract.

This Agreement constitutes the entire agreement between the parties and supersedes all prior negotiations, representations, or agreements, whether written or oral. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Answers to our most asked questions about bookkeeping contract templates

Contact usDiscover more articles that align with your interests and keep exploring.